Google's hourly trend analysis with a focus on Scandinavia

Posted on December 6, 2023 (Last Updated: January 25, 2024)

What have we learned from Black Friday 2023?

Now that Black Friday 2023 has come to an end, we can start analyzing the data to uncover the insights behind this shopping spree.

By getting into the comprehensive stats provided by Google Hourly Trend Reports for the days surrounding Black Friday, we can explore a trove of information that vividly illustrates how consumers made their investment choices in terms of what, when, and how. The demand of the market, its preferences and means of shopping are key to establishing an effective go-to-market strategy for the upcoming year.

%20copy%204.png?width=1920&height=1080&name=Article%20Banners%20(4)%20copy%204.png)

Grab a cup of tea and keep reading this blog as we examine the data and trends, gaining a better understanding of the current retail and what has happened in the past week and most importantly what this means concerning the future. We will provide you with a year-over-year comparison of the quant data so we can monitor the annual changes in consumer spending as a final bit of this study. Let’s begin by exploring the overview of the industries and their respective growth performance.

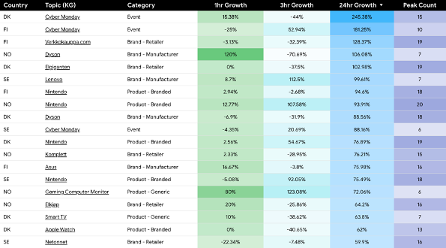

Titles and Categories - Overall Search Trends by Google 2023

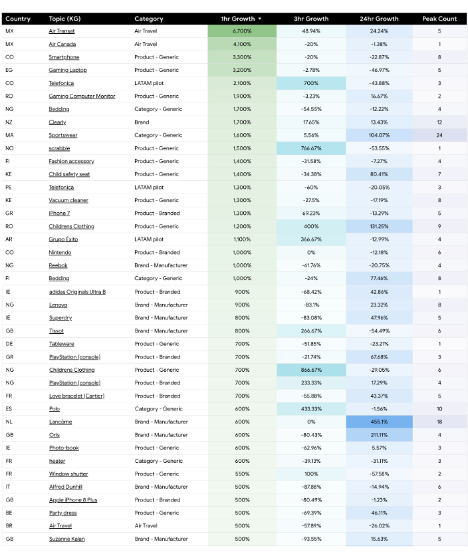

We can begin by outlining the overall trending categories across Europe being air travel, smartphones, gaming appliances, bedding etc.

"On behalf of the industry, I will allow myself to be satisfied and cautiously optimistic," says Niels Ralund, e-commerce director of Dansk Erhverv, after receiving the first round of data on sales in the first three weeks of Black Month. "Overall, we are at an index of 100 and a little more, and that is quite good when we have been significantly below for large parts of the year. This suggests that consumers have saved up for the many offers.”

This citation highlights the positive sales performance of Danish online stores during the Black Month leading up to Black Friday and reflects the cautious optimism in the retail sector.

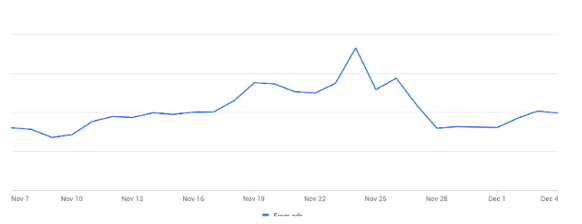

Another resource, Ehandel.se, November 29, 2023, discusses the substantial volume of Google searches in Sweden during Black Friday. Key highlights include:

- Google search interest was notably high right at midnight on Black Friday.

- Although many started searching the weekend before Black Week, Black Friday itself saw unexpected strength in search activity.

- Peak search interest on Google occurred at 9 PM on Black Friday and on the following Sunday at the same time.

- Google Ads accounts experienced a decrease in cost per click on Friday evening.

- Challenges arose due to the unavailability of real-time Universal Analytics data, necessitating closer communication with clients for sales feedback and optimization decisions.

Many are a little surprised by the overall impressive growth numbers for retailers during Black Friday and Black Week. This is stated by HUI's CEO Emma Hernell in Ehandel's podcast Ehandel Svepet.

“I am also quite surprised by these growth figures. Many people say that they sold roughly the same amount as last year. But we must also remember that growth figures are usually measured in current prices and that there is an element of inflation as well.”

In Norway, Black Friday 2023 revealed a variety of consumer behaviours as well as varying results across industries. Footwear emerged as a major industry, with certain companies experiencing sales growth ranging from 48% to 383%. Fashion and Home and garden remained popular with consumers but with a moderate increase (Fashion at 2%). The travel and entertainment industries reported a 134% increase in revenue. In contrast, the Computing industry saw a slump, and the Services sector, particularly Finance, also experienced a drop compared to prior years. Surprisingly, smoking alternatives showed an 86% rise in sales. Retail categories such as Specialty Stores, Department Stores, and Malls were top achievers, with visit spikes greater than in 2022, demonstrating that Black Friday remains relevant despite economic concerns.

Electronics: The Undisputed Champion

%20copy%207.png?width=519&height=292&name=Article%20Banners%20(4)%20copy%207.png)

Hourly Trends by Google - Black Friday

Electronics, as always, stood at the forefront of Black Friday sales, dominating the market with its unbeatable deals. This year, the category experienced an unprecedented 24-hour growth, leaving no doubt about the always-strong purchase habits between consumers and technology. But the story doesn't end there, it only gets more intriguing.

Analyzing the 3-hour growth patterns, it became evident that consumers were more than just casually browsing through the available deals. Instead, they eagerly awaited specific discounts, ready to pounce on them as soon as they went live. This behaviour revealed the true essence of today's tech consumers - a group of savvy and deal-hungry individuals who meticulously plan their shopping strategies to make the most out of the Black Friday frenzy.

The appeal of electronics on Black Friday lies in the promise of acquiring the latest tech marvels at jaw-dropping prices. From state-of-the-art smartphones to high-performance laptops, consumers find themselves irresistibly drawn to the world of electronics, where innovation and savings collide. It's a battlefield of desires, where tech enthusiasts strategize and patiently wait for the perfect moment to strike.

The 24-hour growth in electronics sales showcases the unwavering demand for technological advancements. In a world driven by constant innovation, consumers are always on the lookout for the next big thing. Black Friday serves as the ultimate platform for them to fulfil their desires, offering various deals and discounts that seem too good to resist.

Moreover, the astounding 3-hour growth patterns shed light on the meticulous planning and research done by consumers. They meticulously scour through countless online platforms and meticulously compare prices to ensure they are getting the best possible deal. This level of dedication and attention to detail exemplifies the tenacity of today's tech consumers, who spare no effort in their pursuit of the ultimate bargain.

Electronics Hourly Trends by Google - Black Friday

Fashion: A Stylish Comeback

Fashion's remarkable 24-hour growth trajectory signals a rejuvenated interest in personal style post-pandemic. The 3-hour peaks were like fashion shows, where each hour revealed a new trend. This sector's rebound is not just about clothes, it's about identity, expression, and the joy of dressing up in a world that's gradually opening its doors again. For example, Dyson experienced a 120% increase in searches within the first hour of Black Friday in Norway, similar to Gaming Computer Monitor with an 80% first-hour peak. Verkkokaupa, a client of ours, has seen a staggering 128% growth in searches within 24 hours. Smartwatches were one of the peak searches across Denmark, Finland and Norway making them a trendy product category.

%20copy%209-2.png?width=581&height=327&name=Article%20Banners%20(4)%20copy%209-2.png)

Fashion Industry Titles and Categories Trends - Google Hourly Analysis Black Friday

As the world emerges from the shadow of the pandemic, there is an undeniable shift in the air, and it's not just the change of seasons. People are craving a sense of normalcy, a return to the vibrancy and self-expression that fashion brings. The remarkable 24-hour growth trajectory of the fashion industry serves as a visual representation of this reawakening.

But it's not just about the clothes. Fashion has always been a powerful form of self-expression, a way to showcase one's personality, values, and individuality to the world. After months of loungewear and casual attire, people are eager to reclaim their identity through their wardrobe choices. The resurgence of fashion is a testament to the human desire for self-discovery and the joy of dressing up.

As seen in the table above, children’s clothing was quite popular in Denmark by 63% and 64% growth within the first 3 and 24 hours of sales.

Luxury: The Surprise Contender

The luxury sector, often seen as niche, broke records this Black Friday. The steady 24-hour growth across high-end products tells us that luxury is no longer an inaccessible dream, it's a cherished aspiration for many. Unlike other categories, luxury shopping didn't peak and trough, it was a consistent journey, suggesting a well-informed, discerning consumer base.

What our CSS Merchant Center revealed to us

As a CSS premium provider, we've noted a clear trend: Black Friday shopping starts increasingly earlier each year, reflecting changes in the retail landscape. This shift is driven by competitive pressures among retailers, the growth of online shopping, and changing consumer preferences for longer, more convenient sales periods. This early start to Black Friday sales not only helps retailers capture a larger market share but also spreads out the shopping rush, offering a more manageable experience for both consumers and businesses. We closely monitor these trends to advise our clients on adapting to these evolving shopping behaviours.

Black Friday 2023 in Europe, including the Scandinavian markets, highlighted the growing preference for online shopping, the significant role of mobile devices, and the engagement of younger demographics. Retailers and brands need to adapt to these evolving trends, focusing on digital strategies and catering to the demands of a tech-savvy, environmentally-conscious consumer base.

Timing is Everything

Black Friday is not just about what people buy, it's about when they buy. This year’s hourly data is a goldmine for understanding consumer behaviour. The early morning rush, the midday lull, the evening resurgence – each phase of the day held its pattern, guiding retailers on when to launch their most enticing offers.

Impressions Growth around Black Friday - WakeupData CSS merchants' performance

The data from Black Friday 2023 indicates a notable trend where there was a significant increase in both impressions and clicks starting a week before Black Friday. This suggests that Black Friday sales are not only commencing earlier but also extending beyond the traditional one-day event. Strategically, this underscores the importance of early preparation for businesses. Launching campaigns ahead of time allows for effective testing, ensuring they are well-optimized for success during the extended Black Friday period. This approach is crucial for leveraging the extended interest and engagement seen during this time.

Emerging Trends & Consumer Preferences

The rise in categories like health and beauty or home and garden is a narrative about evolving lifestyles. It’s about people investing in themselves, their health, and their living spaces more passionately than ever.

Strategic Implications for Retailers

For retailers, the message is clear: diversify, personalize, and time your strategies. In the ever-changing tapestry of consumer preferences, staying agile and informed is key to capturing hearts and wallets.

Optimizing Product Feeds for Maximum Impact

An essential component of this agility is the effective management and optimization of product feeds. Product feeds, the backbone of any e-commerce strategy, are especially crucial during high-traffic events like Black Friday. Here are a few key areas to focus on:

- Data Accuracy and Quality: Ensure your product data is accurate and comprehensive. This includes up-to-date information on pricing, availability, and product descriptions.

- Feed Customization: Tailor your feeds for different platforms and channels. Each channel may have its specific requirements and consumer behaviour, requiring a customized approach for maximum effectiveness.

- Dynamic Updates: In fast-paced sales environments, inventory and prices change rapidly. Your product feeds should be dynamically updated to reflect these changes in real time.

- Targeting and Segmentation: Use data from this year's Black Friday to segment and target customers more effectively. Analyze consumer behaviour to create more personalized and targeted campaigns.

- Performance Analysis: Post-Black Friday, analyze the performance of your product feeds. Look at metrics like click-through rates, conversion rates, and ROI to understand what worked and what can be improved.

By optimizing product feeds, retailers can better meet consumer expectations, drive sales, and enhance overall campaign performance, not just during Black Friday but throughout the entire year.

Black Friday 2023 sum-up

Black Friday 2023 was a mix of consumer behaviour, market trends, and strategic revelations. As we analyze and learn from this grand event, we pave the way for smarter, more empathetic business strategies. The data tells us stories of change, resilience, and hope – stories that will shape the retail world in the years to come.

Comparative Analysis: Black Friday Trends 2022 vs. 2023

The Black Friday events of 2022 and 2023 presented some distinct differences in consumer behaviour and market dynamics. In 2023, there was a noticeable acceleration in consumer interest in technology, as evidenced by the substantial growth in the electronics sector compared to the moderate growth in 2022. The fashion industry, which saw steady growth in 2022, experienced a pronounced resurgence in 2023, signalling a rejuvenated interest in personal style post-pandemic. A significant shift was observed in the luxury goods sector, which went from consistent but modest growth in 2022 to unexpected heights in 2023, suggesting a change in consumer investment towards high-end products. Regional shopping patterns also varied considerably, indicating evolving market demographics and preferences. These differences underscore the dynamic nature of consumer spending and the importance of staying attuned to these changes for effective business strategy.

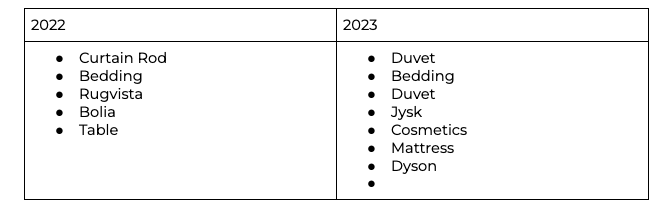

Comparative Table: Black Friday Trends 2022 vs. 2023

This summary and table provide a concise overview of the key differences in trends between Black Friday 2022 and 2023, offering valuable insights for understanding the evolving landscape of consumer behaviour and market dynamics.

Below you can observe the topics with peak results in the 24 hours within Northern Europe compared to the year 2022.

Black Friday 2023 has elucidated the dynamic interplay between consumer preferences and market trends, revealing a landscape where agility and adaptability are key. The electronics sector's explosive growth epitomizes the unyielding consumer demand for technology, while the resurgence in fashion underscores a renewed desire for self-expression post-pandemic. The luxury market's unexpected rise indicates a shift towards aspirational shopping, reflecting evolving consumer aspirations.

These insights, coupled with the strategic need for retailers to diversify and personalize their approaches in response to changing shopping patterns, paint a picture of a retail environment that is rapidly evolving, driven by informed, tech-savvy consumers seeking value, quality, and relevance in their purchases.

If you want to stay on top of the game and get access to impactful, factual data- subscribe to our blog HERE.

If you are in search of a solid partner to manage and optimise your feeds and boost your ad game - book a meeting HERE or a DEMO HERE.

You think you have it all covered? Then try our free feed audit HERE.

%20copy%206.png?width=792&height=446&name=Article%20Banners%20(4)%20copy%206.png)