Denmark Ecommerce 2021 - Consumer Statistics & Channel Recommendations

Posted on July 3, 2018 (Last Updated: February 27, 2024)

Denmark has a population of around 5.8 million, with an estimated 97% having access to the internet.

Danish consumers spent 146 billion DKK online last year, while two thirds of these regularly use the internet for shopping, meaning there is a large and dedicated audience ready to purchase products online.

- Revenue in the eCommerce market amounted to US$4,477m in 2020 (source).

- Revenue is expected to grow annually by 5.5%, leading to a predicted market volume of US$5,546m by 2024 (source).

- The market's largest segment is Electronics & Media which had a market volume of US$1,347m in 2020 (source).

- User penetration is 85.4% was 2020 and is expected to hit 89.0% by 2024 (source).

In fact, a number of categories in the report show that Denmark is leading eCommerce growth in categories like Ease of Doing Business Index, highest spending per online shopper and internet penetration index.

What is driving Denmark's e-commerce growth?

Source: Statista

Source: Statista

Similar to our e-commerce guide to Sweden, the results from Denmark show this is already a mature e-commerce nation with regular online shopping habits.

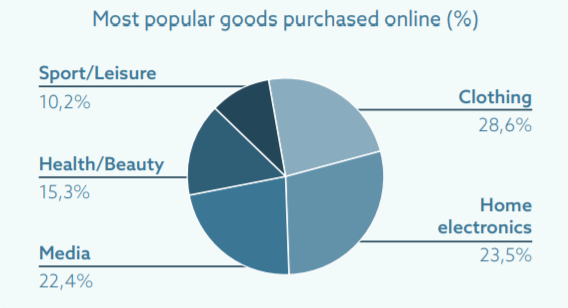

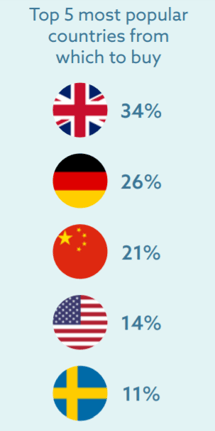

Two-thirds of Danes shop online each month, with only Norwegians spending more per capita (source). As with the other Nordic nations, clothing and footwear ("fashion") are the most popular categories, whilst electronics and media products are also ranked highly.

Two-thirds of Danes shop online each month, with only Norwegians spending more per capita (source). As with the other Nordic nations, clothing and footwear ("fashion") are the most popular categories, whilst electronics and media products are also ranked highly.

Denmark has the highest penetration of smartphones in the world - with 77% of the population using a smartphone (source). This is reflected in the e-commerce industry, with one in four online purchases in Denmark made using a cell phone.

As the graphic below shows (source), consumers consider clarity and navigability of the shopping process to be of paramount importance, but developing attractive and well-designed mobile experiences to attract new customers should also be a priority for attracting a Danish audience.

Consumer behaviour in Denmark

In contrast to Norway, where we saw fairly low expectations when it came to delivery of goods, the Danes have some of the highest demands.

One in ten expects to receive their goods on the following business day, and three in ten, after two business days (source). This is perhaps because Denmark is a small and relatively navigable country geographically (in comparison to its mountainous Nordic neighbours!) leading to clear expectations among consumers concerning rapid service.

Therefore, a prompt internal service to ensure rapid dispatch of goods and a clear returns policy is vital to impressing a Danish audience and ensuring repeat customers.

To succeed in the ecommerce market in Denmark, you need to have as attractive a price as possible. The shopping experience must also be convenient, informative and give the consumer full insight into the deliver process.

Carsten Dalbo Pedersen, Head of E-commerce & logistics, Postnord in Denmark

Shopping channels in Denmark- which to use?

The growth of current shopping trends are forcing merchants to diversify their ecommerce strategy and to explore channels where people are actively searching for a product, wanting to seek the best possible deal through comparison.

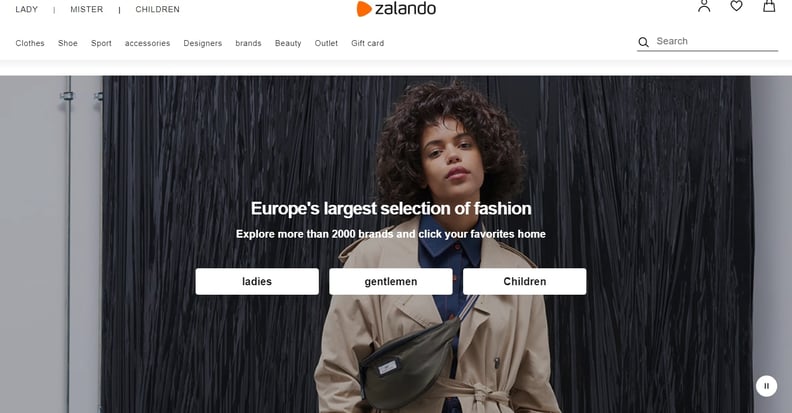

FDIH's analysis delves into where and what consumers do. Clothes, shoes and accessories are still the most purchased product category, with Zalando topping the list for the second year running as the most popular ecommerce site in Denmark:

What about the launch of Amazon.se? What impact might it have on Danish ecommerce?

In July 2020, after long speculation, Amazon announced their intention to launch a Swedish-based site.

"Amazon has been available to Swedish consumers and companies through our various European websites for years, but the next step is to introduce a complete retail offering in Sweden and that is what we are planning to do now,"

Alex Ootes, vice president of EU Expansion at Amazon

The upside for online stores and retailers that lack the resources for internationalization, is that Amazon provides an opportunity to find buyers across the Nordics even if it is at a higher transaction cost than you may be accustomed to.

The move into the Nordic region’s biggest economy comes at a time when the U.S. retail giant is benefiting from an influx of consumers trying to avoid physical stores during the coronavirus pandemic.

But what does the launch of Amazon.se really mean for Sweden's e-commerce?

For now, it remains to be seen.

The first year of launch is predicted not to have a significant impact on Swedish ecommerce. As they seek to establish themselves in a new market, with Nordic-based companies making the transition to add Amazon as a sales channel, then Amazon will push the margins of Swedish and Nordic eretail.

Should merchants who want to reach Nordic consumers sell on Amazon.se?

A new arrival will always take time to gain a significant foothold, and not all companies and brands should seek to jump onto Amazon.se immediately. However, it would be an oversight not to at least investigate the possibilities and potential issues of selling via Amazon.

Failing to make a decision one way or another is where ecommerce retailers can lose out in the long run.

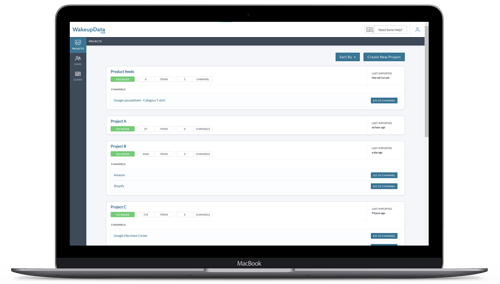

Of course, the channel you select is dependent upon what products you are selling. The list we have compiled offers a shortlist of some options for sellers wishing to break into a Danish market specifically.

Zalando

Zalando are a German ecommerce company based in Berlin, and specializing in offering fashion and lifestyle choices to consumers.

They boast 300 million visits per month, 29 million consumers, 450 thousand product choices and a precense across 17 European markets (source).

To get started with selling on Zalando, the onboarding process requires several validation steps, both manual and automatic. When you contact Zalando to sell your products, an account manager will check that your products are eligible for the marketplace.

They will then provide you with a “MasterData” file containing, among other things, the type of products you are authorized to sell on the platform, as well as the product information expected by Zalando

You can get more info on the Zalando product feed specifications here.

PriceRunner

PriceRunner are a leading shopping comparison site in Sweden, Denmark, France and Germany.

PriceRunner are a leading shopping comparison site in Sweden, Denmark, France and Germany.

Products can be listed on Pricerunner under two types of categories: price comparison categories and shopping categories. Each category has its own characteristics.

Requirements for Merchants:

- Merchants need to have at least 200 products in their inventory;

- The products listed must all be in new condition;

- It is recommended that you advertise more than 80% of your inventory on Pricerunner;

- All the product feeds on our site are updated on Pricerunner between midnight and 4am each night.

You can check their product feed specifications plus all the recommendations here.

Related: Get more info on our PriceRunner Integration here.

Coolshop

Coolshop is the first Scandinavian Marketplace stretching into seven countries - Denmark, Norway, Sweden, Finland, Germany, Netherlands and United Kingdom.

An online retailer primarily selling video games and consoles at source, Coolshop has begun rapidly expanding its retail categories in recent years - seeking out new opportunities and leading technological development.

Their feed requirements include EAN code, brand, Primary Color and Size - click here to find out more.

Related: Get more info on our CoolShop Integration here.

Partner Ads

Partner ads is a Danish affiliate network active since 2002. They have over 2000 affiliate partners in their focus markets across Denmark, Sweden and Norway.

Merchants can start adversting on Partner ads by uploading their product feeds to Partner-ads in a XML format, you can find out their feed specifications here.

Related: Get more info on our Partner Ads Integration here.

Reaching out to your Danish audience

As the statistics mentioned above show us, there is a rapidly growing number of Danish consumers who are shopping online regularly.

Take the time to select which channel might be right for you. Check out their product categories to see if they support your products categories and consider carrying out a trial campaign to see if you get results.

Looking to expand your reach in Europe? Check out our guides to selling in the Netherlands, Sweden, Germany, Finland and Norway or check out our eCommerce Guide to Selling in the Nordics below 👇