Black Friday Purchasing for the Nordics - Consumer Data Trends

Posted on November 12, 2019 (Last Updated: January 25, 2024)

Black Friday in 2020 could be a bit different. Thousands of industries have been hit by the Covid-19 pandemic, and this Holiday Period promises to be a vital period for survival.

Given the events of 2020, predicting the landscape of this year's Black Friday is challenging. One thing we can be certain of is that product feeds will continue to play a vital role in the success of ecommerce campaigns during this busy period.

Let’s take a look at the latest data, and find ways to stand out from the crowd during the most competitive day of the year.

Somewhat similar situation hit the world by storm in 2022, the inflation rose and living costs got record high, in the EU reaching 9.2%.

Regardless of the situation, Black Friday wet really well, even when compared to the previous years. However it is important to note, that the sales were not increasing over the whole Black Month, but did increase on Black Friday by 2.3% when compared to 2021.

What will Black Friday look like in 2020?

It is expected that up to 30% of global retail sales will be made through digital channels during the holiday season (source: yougov).

Worldwide, the majority of brick-and-mortar stores will be closed, with more consumers moving online in favour of their usual methods.

Furthermore, shoppers don’t plan on spending less for their holiday shopping this year in comparison to 2019, in fact 72% of shoppers plan to shop more online this holiday season.

The uncertainty around in-store shopping and the hype around ecommerce means many physical stores are now prioritising online shopping as an alternative, with the arrival of 2020 initiatives like:

What do the statistics look like for Denmark and the rest of the Nordics?

When are your customers going to make a purchase in the days and hours around this e-commerce season?

Black Friday is now just a few weeks away and, if you're an e-commerce retailer or digital marketer, the chances are that you've already started preparing for the giant

e-commerce day.

Each and every online store will be able to gain a share of the spoils that Black Friday offers - providing they are properly prepared in time!

In this article, we are using data from over 1000 webshops in the Nordics (courtesy of Clearhaus). From millions of rows of data we've pulled out the most interesting stats for the entire Black Friday week for online stores in industries for:

- Clothing 👗

- Accessories 💍

- Sporting Goods ⚽

We'll find out how sales and buying behaviour differ between industries, and provide some key take-away messages for retailers and digital marketers.

The next step is to look at some statistics from 2019, but before we do, here is some information from a more recent Black Friday in 2022 to help you broaden your understanding of the topic.

Overall, the demand on Black Friday (-8.66%) and Black Week (-7.03%) has slightly dropped from 2021, however, it is important to note that the Black Month demand had increased compared to the previous year by 9.32%.

That being said, most of the online activity was tracked at midnight from Thursday to Black Friday, along with Friday morning at 9.

Looking at the stats from the previous year, the most popular category was electronic devices (36%), followed by clothing and accessories (17%), while kitchen and home goods stood lower (12%) along with sporting goods (8%) (source).

The Clothing/Fashion Industry

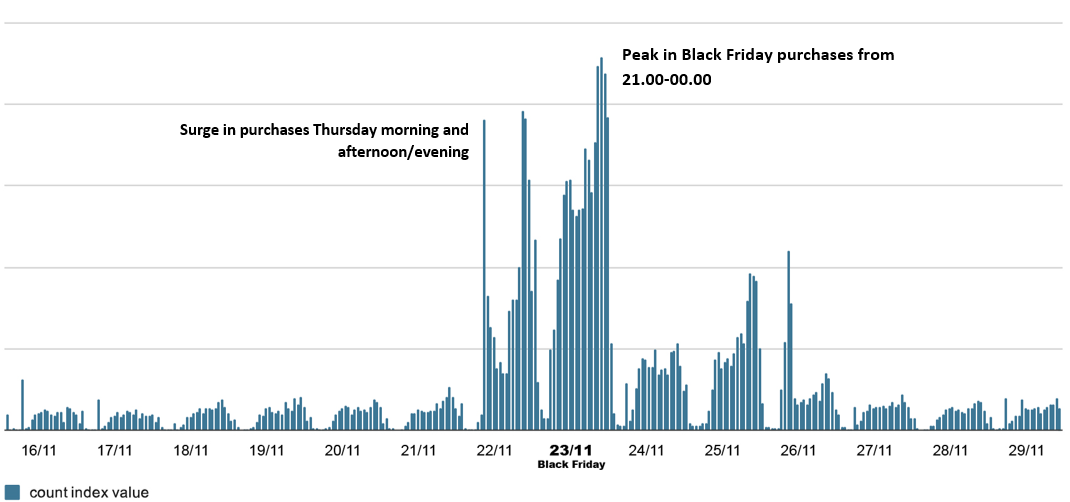

Nordic Clothing Industry webshop data for transactions from 16th-29th November 2019.

On an average day, most people do their online shopping around 19:00, but for last year's Black Friday (23rd November) we can see that the overall number of transactions (plus the overall value) begins to dramatically increase at around 18.00, reaching its peak at around 2100.

From 21 - 23 there are 1000+ transactions per hour, a boost in purchases which doesn't decrease until after midnight on the Saturday.

- Perhaps the most surprising element of the clothing industry data are the two surges in traffic that occured in the early morning and afternoon/evening of the previous day (Thursday 22nd). This most likely correlates with pre- and post- work ecommerce browsing.

It's clear here that the "FOMO" (Fear of Missing Out) is playing a role in the buyer behaviours of the Nordics - with shoppers not risking postponing their chance at large savings, and turning instead to ecommerce purchases the day before the traditional Black Friday date. - We also see an above-average level of online purchasing continuing through the weekend and, most interestingly, surging on Sunday evening and early Monday morning when many online store's offers were drawing to an end.

Huge potential for big sales in clothing industry in the Nordics

As will become clear in this article, not all industries are born equal when it comes to Black Friday.

As the Clearhaus data showed us last year, fashion shops were the big winner - with a 791% more sold on Black Friday itself when compared to the average day.

So how to get a piece of this action?

- Ensure your promotional campaigns are in place for the Thursday (26th November 2020).

- Run entirely different offers for the following weekend to ensure interest remains and you attract follow-up purchases from existing customers.

- Ensure frequent updates of your feeds to meet the busy purchase demands on clothing stores at this time.

The Accessories/Jewelry Industry

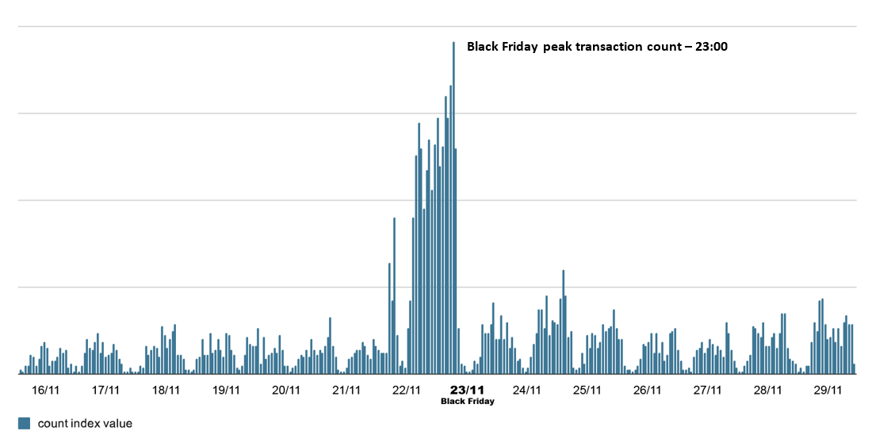

Nordic Accessories Industry webshop data for transactions from 16th-29th November 2019.

Unlike the data for the fashion industry above, we see nothing like the same increase in traffic and purchases for the Thursday preceding Black Friday.

- From 23.00 until 01.00 from the 22nd to the 23rd last year we do see a sudden surge in purchasing in the Nordics (trebling the average number of purchases per hour for this industry).

This uptick is most likely based on the onset of promotions at midnight and the FOMO for online shoppers.- Similar to the fashion industry, there is a steady increase in purchases throughout Black Friday itself, reaching a zenith between 23.00 and midnight. Surprisingly, there is little impact on the proceeding weekend - pointing to a Friday-centric focus for this industry.

Key take-aways for accessories/jewellery retailers

Although not as significant as the clothing industry, there is great potential to attract 4-5 times the average number of purchasers during Black Friday

- Ensure your promotional campaigns are in place for an uptick in traffic that began last year on Thursday evening (26th November 2020).

- As the purchase peak reaches 5 times the hourly average for this industry, ensure frequent updates of your feeds across all your sales and marketing channels to meet the busy demands.

- Make sure that your product images are eye-catching and engaging for your audience to encourage purchasing through FOMO on offers.

Sports

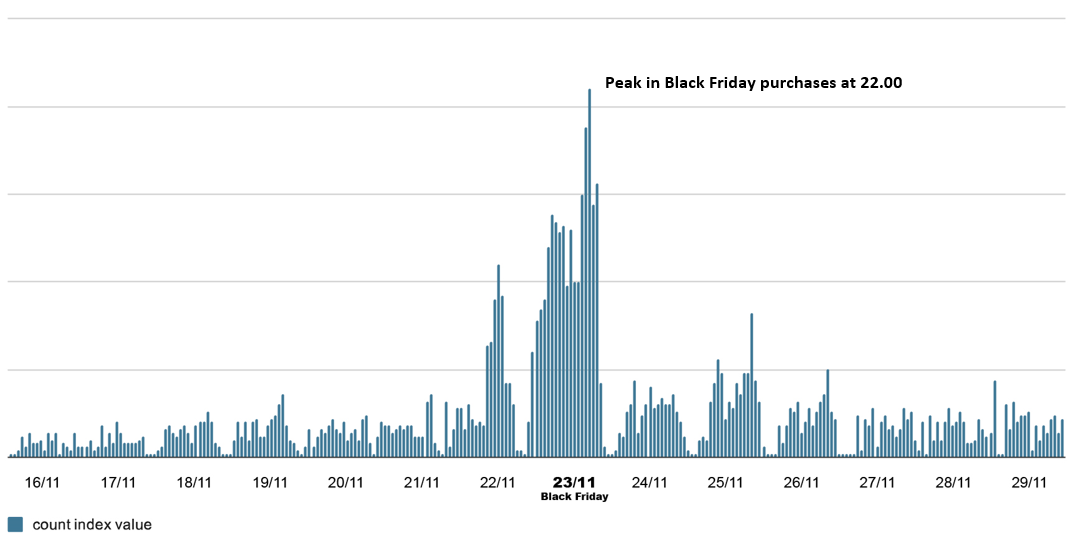

Nordic Sports Industry webshop data for transactions from 16th-29th November 2019.

- We see the start of this season on the graph above for sporting industry goods, where Thursday 22nd from 19.00 - midnight saw an increase in the number of purchases from online retailers.

- Popularity grows exponentially from the early morning of Black Friday throughout the day, reaching a peak between 22.00-23.00 - where the number of 2018 purchases from Nordic retailers reached 5x the industry hourly average.

Key take-aways for sports industry retailers

- Ensure your promotional campaigns are in place for the morning of Thursday (26th November 2020).

- As with the clothing/fashion industry, consider running different offers for the following weekend (Saturday 30th November - Sunday 1st December) to meet the potential increase in traffic that we see remained until the following Monday last year.

- And of course, to avoid misinformation being included - make sure you are frequently updating your feeds across all your sales channels.

Prepare and optimise your feed for Black Friday

The most important factor in all of the Black Friday preparation?

Getting your product feeds ready for maximising ROI and revenue. For Google Shopping, this includes factors such as:

- Improving product images, descriptions and titles

- Adjusting pricing strategies and using Custom labels

- Adding missing info and merging extra data to feeds

We created a blog article with all the tips for preparing your Google Shopping feed, plus a free analysis and audit in time for the big weekend. Check it out right here:

How to Optimize your Google Shopping product feeds for Black Friday

Summary

It's probably an understatement to say that this Black Friday is going to be different. Retailers need to adapt their holiday marketing strategies to meet the latest trends.

To make the most of this wave of new online opportunities during this lucrative time, consider:

- Running relevant promotions which you frequently update.

- Optimising your product listings for individual sales channels

- Adding extra factors to product images to draw audience attention

If you want any advice on how to get your Black Friday promotions to the right audiences at the right time, across all your sales channels, please don't hesitate in reaching out to us.

When the potential for increased sales is growing, we're here to listen to your needs and goals and tailor our approach to how we can help you gain optimal results:

* All industry data courtesy of Clearhaus